Contents:

A triangle pattern is generally considered to be forming when it includes at least five touches of support and resistance. Determine significant support and resistance levels with the help of pivot points. Once you see the pattern setting up, you can wait for a touch of the uptrend line and then place a long entry. The benefits with this approach are that you can place a tighter stop since you are closer to the demand line , This also gives you profit before the stock hits the high of the day. The uptrend line breakdown if you are looking to get long is the better of the two. This is because if you wait for the resistance level to be breached before you buy, you would not be in the trade.

As you can see, the length of the AB line is equal to the CD line, which may help in identifying the ideal profit target at the point of a breakout. The technique is simple and has one goal – to help you find a profit target. Based on this technique, the height from the A to the B point should be equal to the price movement following the breakout.

Learn the Ascending Triangle Pattern & How to Trade It

What happens during this time is that there is a certain level that the buyers cannot seem to exceed. However, they are gradually starting to push the price up as evidenced by the higher lows. Learn how to trade forex in a fun and easy-to-understand format. This helps in the scenario where the stock rolls over and breaches the uptrend line, but does not break the low of the breakout candle.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

We’re also a community of traders that support each other on our daily trading journey. Placing an entry order above the top of the triangle and going for a target as high as the height of the formation would’ve yielded nice profits. After the upside breakout, it proceeded to surge higher, by around the same vertical distance as the height of the triangle. In this case, the price ended up breaking above the top of the triangle pattern.

quiz: Understanding inverse head and shoulders chart pattern

A stop loss is placed just outside the opposite side of the https://g-markets.net/. For example, if a long trade is taken on an upside breakout, a stop loss is placed just below the lower trendline. Triangle is a classic price action pattern that is applied by technical analysts to make predictions trading different financial markets. Depending on the shape of the triangle, there are three main variations of this pattern.

StocksToTrade in no way warrants the solvency, financial condition, or investment advisability ofany of the securities mentioned in communications or websites. In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. The markets and penny stock action were slower this week … It’s the week leading up to the biggest summer holiday of…

quiz: Understanding symmetrical triangle chart patterns

As a continuation pattern, naturally we need a preceding trend. In the case of the ascending triangle, which is a bullish pattern, we need to have a prior uptrend. Normally, the price action consolidates inside the ascending triangle formation. This means that there is an ongoing battle between the bulls and the bears. Assessing who is going to win this battle can be done by looking at the RSI readings.

Ideally, it’ll come all the way back up to the same price it fell from before. That gives you the second point, and you can draw an even horizontal line across the top. When all you’ve got is a hammer, everything looks like a nail.

Ascending triangles chart patterns

Access to real-time market data is conditioned on acceptance of the exchange agreements. Futures, futures options, and forex trading services provided by Charles Schwab Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read theRisk Disclosure Statementprior to trading futures products.

Options are not suitable for all ascending triangle pattern as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. During the pattern’s formation, there are a few indicators that can be used to determine whether the pattern is a real pattern or a disguise.

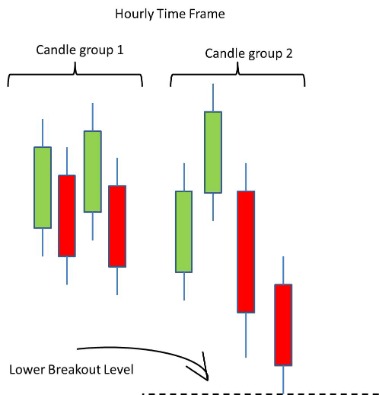

I now would like to touch on ascending triangle stock patterns that fail. Now failure is relative depending on how you are trading the setup. The other key piece is the clear resistance level with a series of highs occurring at or near the same price. You don’t want to have one or two peaks, this my friend is just a swing high or double top. The first key component of the formation is a series of higher lows. This allows me to draw an uptrend line going into the breakout.

How Did Macy’s Buck the Retail Trend and Raise 2023 Forecasts? – Nasdaq

How Did Macy’s Buck the Retail Trend and Raise 2023 Forecasts?.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

At one point, the consolidation phase starts, which gives the buyers breathing space as they regroup for another push higher. These temporary pauses can take different forms, with the ascending triangle being one of them. Breakout – The break of the upper flat line marks the breakout, which activates the pattern. It also helps us determine the entry, take profit, and stop loss at a later stage. A profit target is calculated by taking the height of the triangle, at its thickest point, and adding or subtracting that to/from the breakout point. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

Think of the lower line of the triangle, or lower trendline, as the demand line, which represents support on the chart. At this point, the buyers of the issue outpace the sellers, and the stock’s price begins to rise. The supply line is the top line of the triangle and represents the overbought side of the market when investors are going out taking profits with them. Triangle patterns — in all their variations — can help you find trading opportunities. Learning to spot ascending triangles is a great tool no matter your level of market experience. With an ascending triangle, you’ve got resistance across the top and a rising trendline on the bottom.

Gold short-term analysis – 17 March 2023 – FXCM

Gold short-term analysis – 17 March 2023.

Posted: Fri, 17 Mar 2023 07:00:00 GMT [source]

Volume tends to be stronger during trending periods than during consolidation periods. A triangle is a type of consolidation, and therefore volume tends to contract during an ascending triangle. As mentioned, traders look for volume to increase on a breakout, as this helps confirm the price is likely to keep heading in the breakout direction. If the price breaks out on low volume, that is a warning sign that the breakout lacks strength.

However, the indicator is the opposite of a falling wedge that indicates potential upside. When trading the ascending triangle, traders need to identify the uptrend and this can be seen in the USD/CAD chart below. Thereafter, the ascending triangle appears as the forex candlesticks start to consolidate. The measuring technique can be applied once the triangle forms, as traders anticipate the breakout. To find the profit target, simply take the high and the low of the ascending triangle formation and add that measurement to the breakout level.